Warehouse Facility Finance

Contact Us

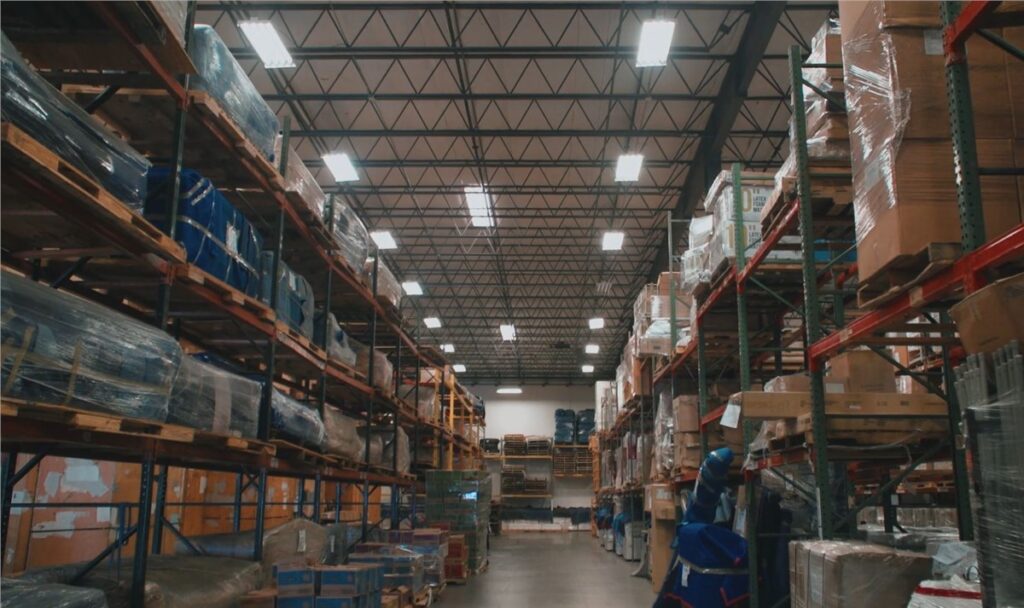

Warehouse financing is a type of description financing that involves a loan made by a financial institution to a manufacturer, company, or processor. Commodities, existing inventory, and goods are transferred to a warehouse and used as collateral for the loan. Warehouse facility finance is often used by private small owned firms, particularly those in businesses related to commodities.

Warehouse financing is another way for businesses to loan money secured by their inventories. Goods and commodities used as collateral will be moved and stored at a warehouse. The warehouse goods are inspected and certified by a collateral manager to ensure the borrower owns the assets used to back the loan.

Understanding Warehousing Finance

This is an option for wholesalers, small to medium-sized retailers. For a warehouse facility finance loan, the collateral is held in public warehouses and approved by the lender. The company’s inventory is accepted by the bank and then transferred to a warehouse controlled by a third party.

If the company does not accept the loan, the bank sells the commodities to cover the loan. On the contrary, the company can begin taking possession of the collateral or repays the loan. Commercial Real Estate Loan Pros of Gainesville designates a collateral manager who certifies the quality and quantity of the goods.

Any inventory tends to depreciate over time. Warehouse facility finance may not be able to offer the entire initial cost of the inventory.

The Benefits of Warehouse Finance

Warehouse financing helps borrowers to get financing on favorable terms than short-term capital and unsecured loans. The actual usage of materials or inventories can be coordinated by the repayment method. The significant benefit of warehouse facility financing is the ability of borrowers to use their raw materials, commodity, and other goods as collateral for the loan.

This type of financing is a secured loan that is cost-effective, unlike other forms of loan. Also, the terms of warehouse financing are flexible and favorable to the borrower, small businesses, and manufacturers’ leverage on this type of loan. The type of loan is secure and less expensive compared to others. If the borrower fails to pay, the collateral in the warehouse is pledged, then sell it to recover the loan. Since the lender is not involved in legal battles, warehouse facility finance is expensive.

A Commercial Real Estate Loan Pros of Gainesville can lower the borrowing costs, secure a larger loan and improve credit rating when using warehouse financing. It offers an advantage to a small-sized company without resources.

Why is Warehouse Facility Finance Important?

Warehouse financing lets companies borrow capital using inventory as collateral. Mostly, the financing has better and more flexible terms compared to other forms of short-term financing. In many cases, borrowers can keep the collateral inventory in their existing warehouses. The lenders often require them to keep away the collateral inventory from the rest of the inventory with a fence and signage.

At Commercial Real Estate Loan Pros of Gainesville, all of our content is verified for accuracy and our team of certified professionals. We pride ourselves on transparency, research, quality and, we value your feedback.

There are so many areas or regions where we offer these services with most of them being cities.

However, if you need any of these services, you need to contact us. The list below comprises the areas where we offer these services.